Plan Your Finances Like A Boss

The 60-20-20 Budgeting Rule That Will Have You Planning Like A BOSS

They say money can’t buy happiness but having some money for rainy days can sure eliminate stress in unplanned situations. An article by The Star stated that 52% of Malaysians have difficulty raising RM1,000 funds in an emergency. Are you part of the 52%? Where do you stand in this current climate with your personal finances/ Do you need to reconsider your spending habits? Overwhelmed and unsure how to rework your finances? Don’t fret! We’re here to help you plan your finances like a boss!

Follow the 60-20-20 rule

According to our partner, Principal Asset Management Bhd, we should always divide our money into 3 categories:

60% spend:

This goes into items for your daily needs and security such as groceries, utilities bills, housing, transportation, and health insurance.

#Tip 1: go CASHLESS! It is safer to use us than using cash as it’s contactless, and minus further risk as you don’t need to go out to look for an ATM to withdraw money!

#Tip 2: Don’t just spend, spend, spend. Track your spending by using Touch ‘n Go eWallet. Once you know how much you need to spend monthly, cash-in the amount on your pay day to avoid the hassle of multiple cash-ins. Even better, put your money in GO+ balance, you’ll also get daily returns on your available balance!

20% savings:

There’s no hard and fast rules to this but you should set aside 15% to clear off your debts such as credit card, PTPTN or related student or car loans. The remaining 5% should go into an emergency funds.

#Tip: Begin with clearing your largest chunk of debt first. Once that is done, move on to repaying your smaller debts.

20% invest:

This is to ensure your income can go beyond your pay check for your long-term (like a retirement fund) and shot-term goals (like much-needed minor home repairs or upgrades).

#Tip: Not ready for investment yet? It’s alright too! But make sure you lookout for tools that will always do more for your money. Features such as GO+ will benefit you because it lets you

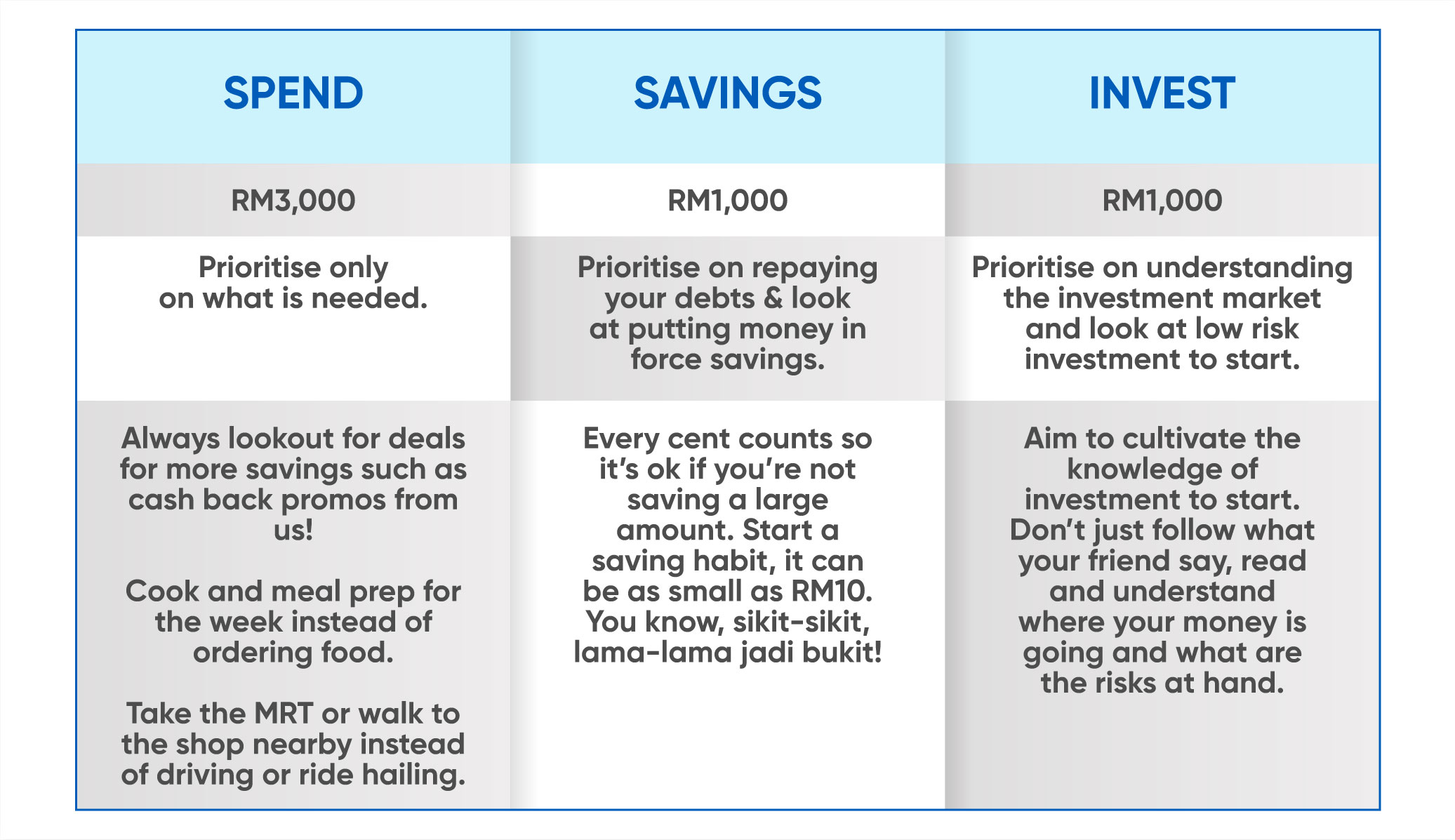

So if your take home net income is RM5,000, this is what we will recommend on how you should divide your money

Now that you know how to be smart about your money, go ahead and start planning your finances like a BOSS! Cash in your money into GO+ today!